student loan debt relief tax credit 2020

Thats achieved by consolidating your debt into a refinanced loan corporate speak for a. You can claim the Student Loan Debt Relief Tax Credit if you meet the following conditions.

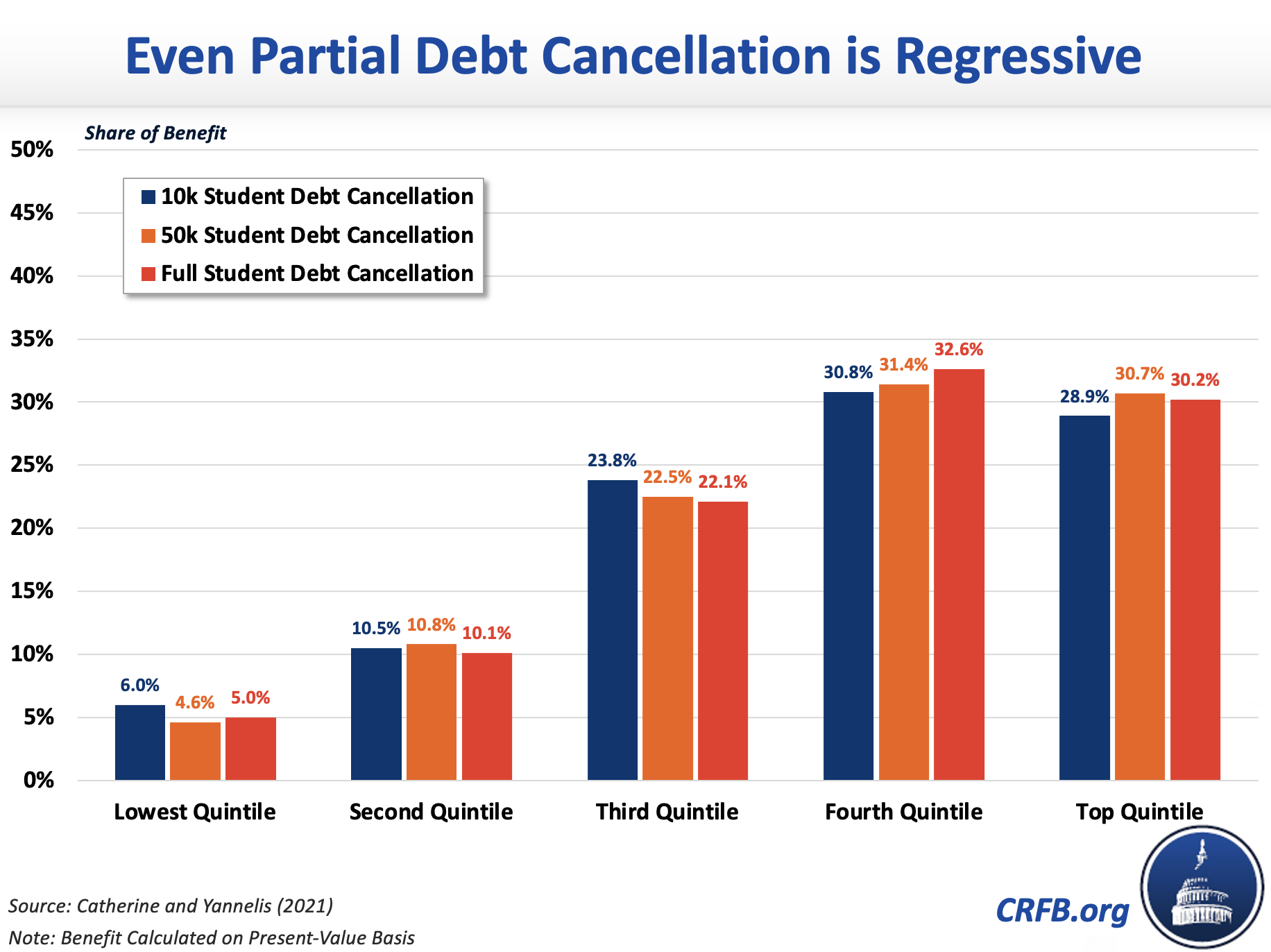

The Case Against Student Loan Forgiveness

It requires a completely separate form attached to a Form 1040 tax return and receipt of a Form 1098-T from the institution where the student was enrolled.

. You have at least 5000 in outstanding undergraduate student loan debt when you submitted an application for certification to the Maryland Higher Education Commission. From July 1 2022 through September 15 2022. If you paid 1000 in student loan interest and youre in the 22 tax bracket youd multiply 1000 22 to.

Have at least 5000 in outstanding student loan debt remaining during 2019 tax year. The AOTC offers a credit of 100 on the first 2000 of qualifying educational expenses and 25 on the next 2000 for a maximum of 2500. To qualify for the Student Loan Debt Relief Tax Credit you must.

2018-39 provide the following relief. Until the end of 2020 employers can contribute up to 5250 toward an employees student loan balance and the payment will be free from payroll and income tax under a provision in the Coronavirus Aid Relief and Economic. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund.

The average debt for adults between the ages of 50 to 61 is slightly lower. You have incurred at least 20000 in total undergraduate andor graduate student loan debt. The enhanced property tax credit is a flat percentage of 585 for the local property tax credit and 315 for the state tax credit in each of the first 24 tax years.

I didnt receive anything in the mail in December about it like I did last year although everything through USPS is delayed right now. When you use student loan funds to finance your education if you are eligible the IRS allows you to claim qualifying expenses that you pay with those funds towards educational tax credits. When a school shuts down student-loan borrowers are often entitled to debt forgivenessBut a new GAO report found issues with communicating that relief to When a school closes down student-loan.

Match with the search results. The tax credit is claimed on the recipients Maryland income tax return when they file their Maryland taxes. In 2019 IRS tax law allows you to claim a student loan interest deduction of 2500 on your 2018 Taxes as long as you and your student loans meet certain eligibility criteria.

2 the IRS will not assert that these taxpayers must increase their gross income by the amount. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit. If the credit is more than the taxes owed they will receive a tax refund for the difference.

Heres more about how student loans and educational. The government has loan forgiveness options for low-income borrowers but if you have a large amount of debt and a high income you would benefit from a lower interest rate the other type of debt relief. To be considered for the tax credit applicants must complete the application and submit student loan.

This page is a benefit walk-through guide for How does student support affect tax credits. File Maryland State Income Taxes for the 2019 year. 56 For adults between the ages of 35 and 49 the average individual balance owed exceeded 42000.

Provide partial debt cancellation for each borrower with household gross income between 100001 and. Everyone is always looking for ways to reduce their tax liabilities but many people have no idea that this significant tax deduction is widely available. 06092020 1215 AM Average star voting.

A tax deduction is also available for the interest payments you make when you start repaying your qualified education loans. 5 28550 reviews Summary. The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income MAGI amount reaches the.

Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the. Student Loan Debt Relief Act legislation to cancel student loan debt for 42 million Americans. 1 the Internal Revenue Service IRS will not assert that these taxpayers must recognize gross income resulting from the discharge of these Federal and private student loans.

Incurred at least 20000 in total student loan debt. You can get a rough idea of how much youll save by multiplying the amount of student loan interest you can deduct by your tax bracket. Cancel up to 50000 in student loan debt for borrowers with 100000 or less in household gross income.

Put another way. As of 2021 approximately 78 million Americans from 18-25 carry student loan debt with an average balance of almost 15000. One of Congresss economic responses to the COVID-19 crisis is a temporary tax incentive for companies to help employees pay their student debt.

Currently owe at least a 5000 outstanding student loan debt balance. The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by providing a tax credit on their Maryland State income tax return. You may deduct the lesser of 2500 or the amount of interest you actually paid during the year.

The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward status on the Maryland OneStop portal to see if you were awarded anything. If the credit is more than the state tax liability the unused credit may be carried forward for the next five 5 taxable years.

Submitted an application to the MHEC by September 15 2019. Lower interest rates loan forgiveness debt relief. Complete the Student Loan Debt Relief Tax Credit application.

Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and.

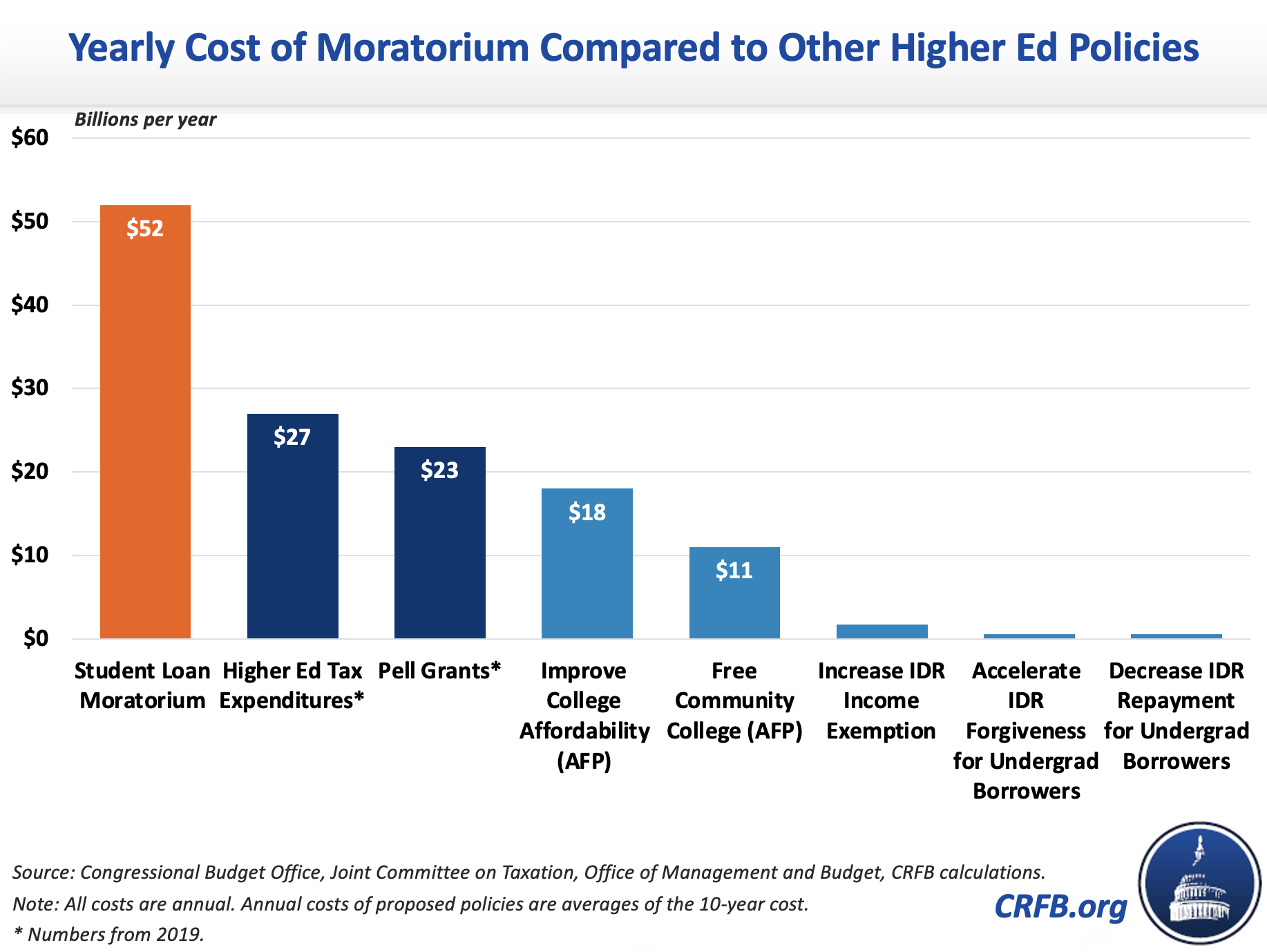

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget

Covid 19 Relief Bill Passes With Tax Free Status For Student Loan Forgiveness

Is Taking On More Student Debt Bad For Students Econofact

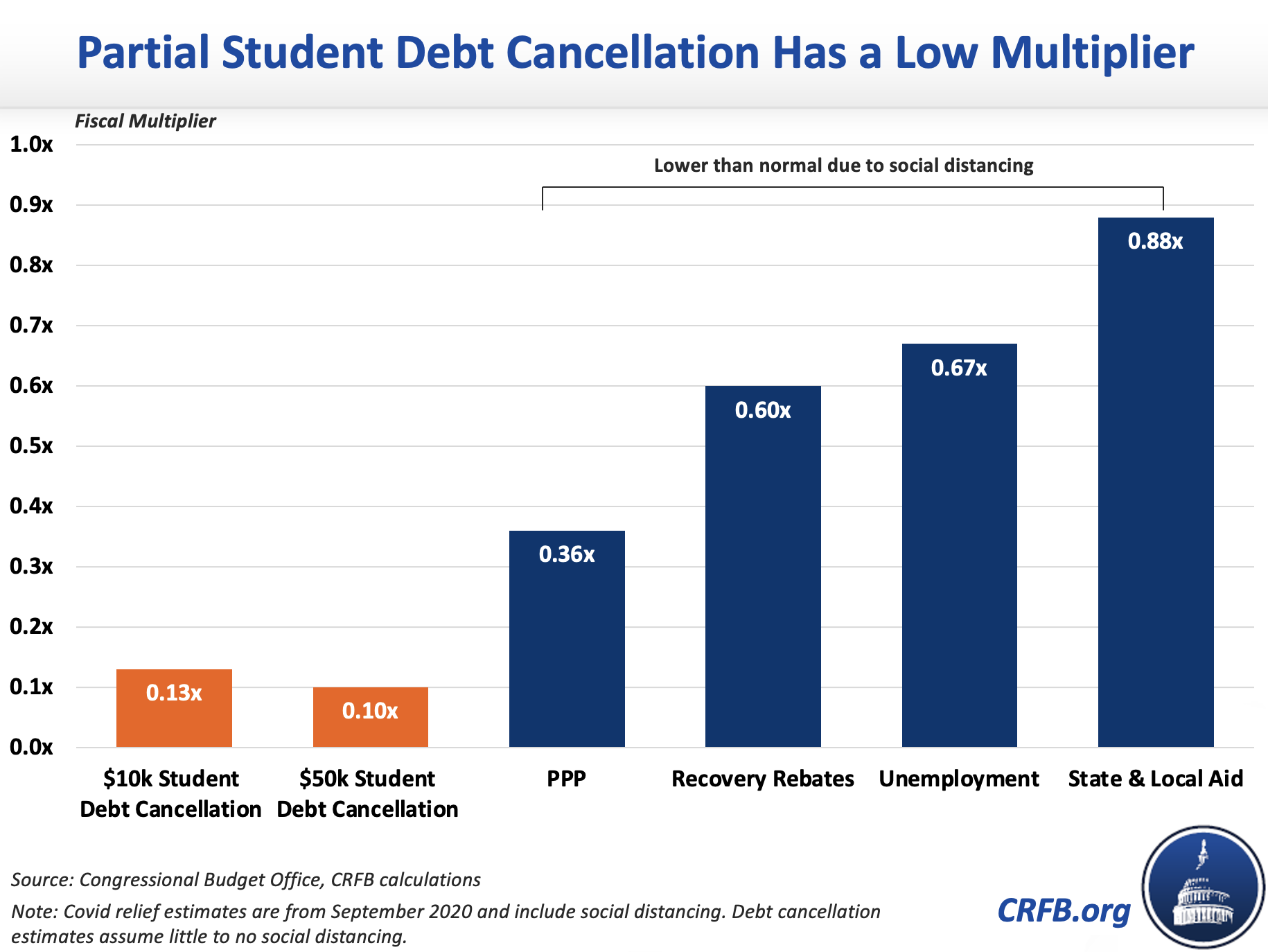

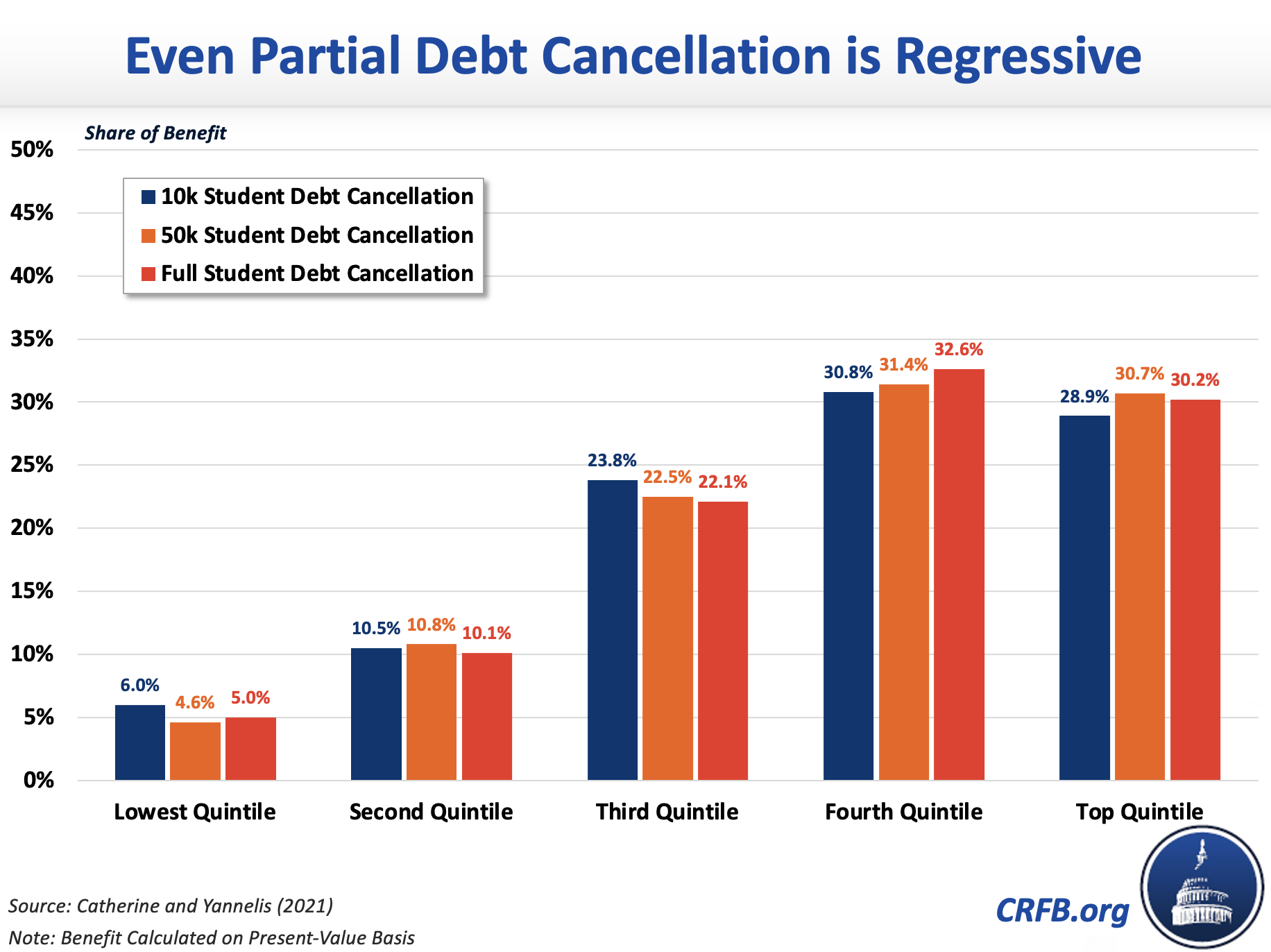

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

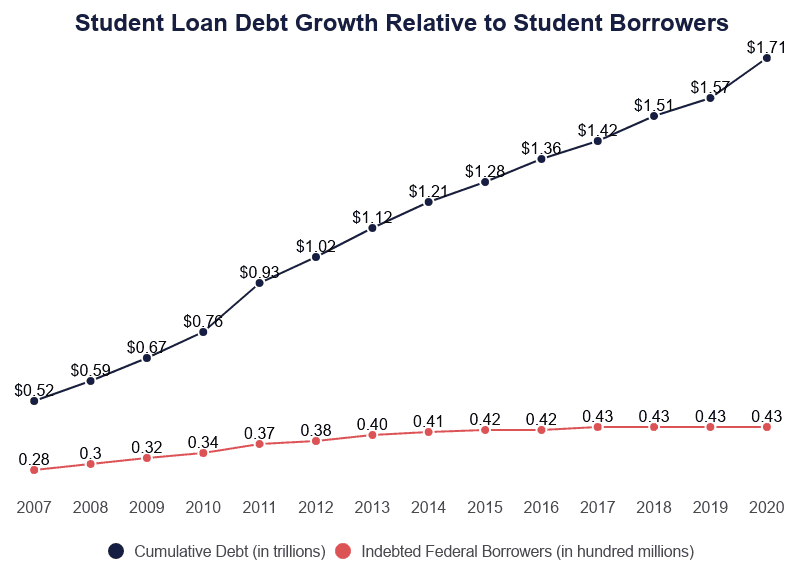

Chart Americans Owe 1 75 Trillion In Student Debt Statista

Can I Get A Student Loan Tax Deduction The Turbotax Blog

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

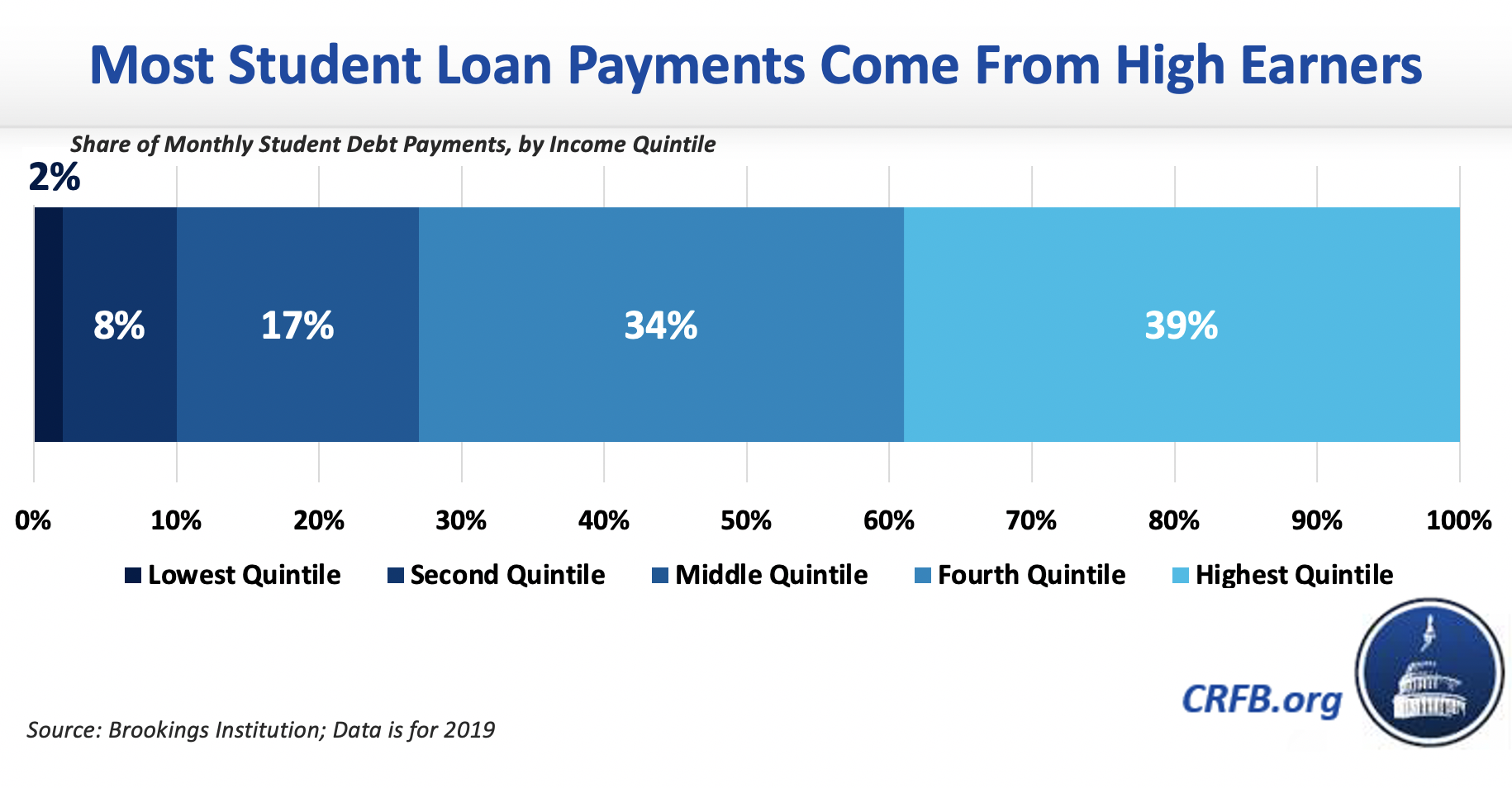

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

Can I Get A Student Loan Tax Deduction The Turbotax Blog

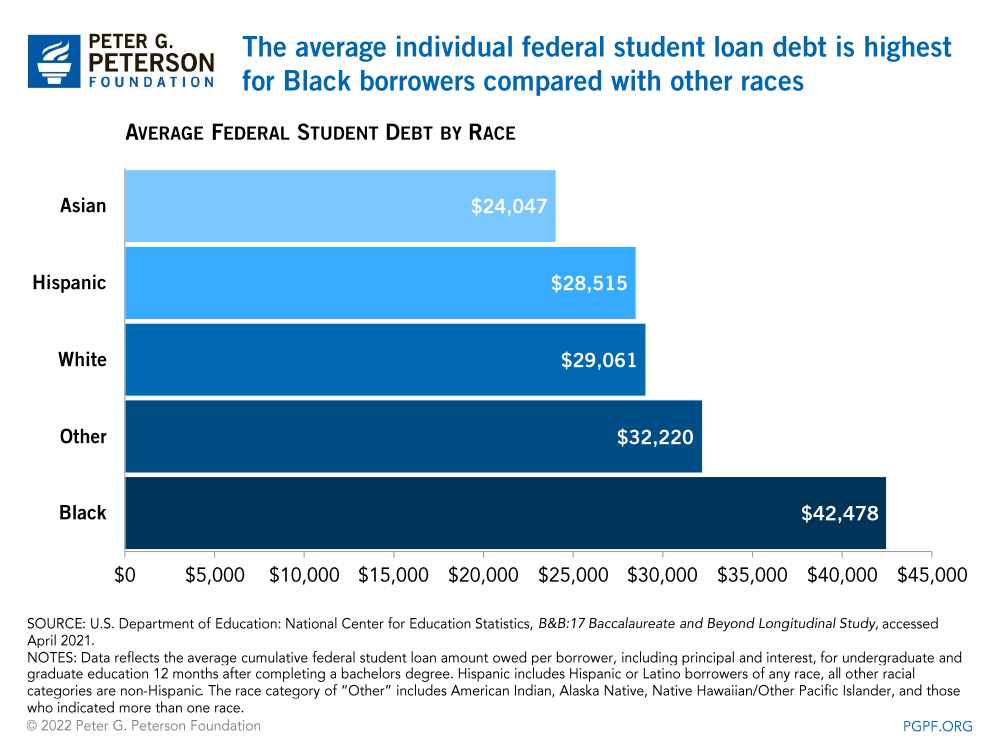

Who Owes The Most Student Loan Debt

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Student Loan Forgiveness Statistics 2022 Pslf Data

Coronavirus Student Loan Payment And Debt Relief Options Credit Karma

What Are The Pros And Cons Of Student Loan Forgiveness

Student Loan Debt Crisis In America By The Numbers Educationdata Org

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero